-

Tax Policy Management

Tax Policy Management

-

Growth Management

Growth Management

-

Tax audit and litigation

Tax audit and litigation

-

Definition of a strategic and secure transfer pricing structure

Definition of a strategic and secure transfer pricing structure

-

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

-

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

-

Annual declaration and documentation obligations

Annual declaration and documentation obligations

-

Domestic and international VAT applicable to your company's flow

Domestic and international VAT applicable to your company's flow

-

Banking and financial VAT, VAT in the insurance sector

Banking and financial VAT, VAT in the insurance sector

-

VAT related to real estate registration fees

VAT related to real estate registration fees

-

VAT in the public and non-profit / association sector

VAT in the public and non-profit / association sector

-

Tax audit, tax litigation and relations with the Tax authorities

Tax audit, tax litigation and relations with the Tax authorities

-

Applicable rules for invoicing

Applicable rules for invoicing

-

Customs issues related to your company's international flows

Customs issues related to your company's international flows

-

French VAT registration and compliance obligations

French VAT registration and compliance obligations

-

Payroll tax

Payroll tax

-

Other indirect taxation

Other indirect taxation

-

Company transfer diagnosis

Company transfer diagnosis

-

Distribution strategy : Implementing and structuring

Distribution strategy : Implementing and structuring

-

Distribution activities digitalisation

Distribution activities digitalisation

-

Relations between suppliers and distributors

Relations between suppliers and distributors

-

Contractual policy : etablishing and structuring

Contractual policy : etablishing and structuring

-

Controls and litigation regarding payment terms

Controls and litigation regarding payment terms

-

Organising and securing commercial relations with consumers

Organising and securing commercial relations with consumers

-

Data protection - GDPR

Data protection - GDPR

-

Commercial Leases

Support in the management and contract management of commercial leases.

-

Traditional Services offered

Traditional Services offered

-

Health at work and quality of life at work

Health at work and quality of life at work

-

HR Management Audit

HR Management Audit

-

HR Engineering and People Change

Implementing managerial solutions in line with the company's strategic challenges

-

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

-

Advice on legal structuring

Advice on legal structuring

-

Day to day company management

Day to day company management

-

Companies reorganisation

Companies reorganisation

-

Mergers & Acquisitions - Private Equity

Mergers & Acquisitions - Private Equity

-

Changes in shareholder structure - Securities issue

Changes in shareholder structure - Securities issue

-

Governance and legal risks management

Governance and legal risks management

-

Development of an international mobility policy

Development of an international mobility policy

-

Coordination of reporting obligations for employees in a mobility situation

Coordination of reporting obligations for employees in a mobility situation

-

Advice on social security

Advice on social security

-

Assistance in labour law

Assistance in labour law

-

Management and protection of your portfolio of property rights

We put the most appropriate protection policy in place for our clients’ intellectual property rights.

-

Securing your projects: advisory and drafting of agreement services

We advise you on the feasibility of your project and the securing of your intellectual property and IT rights.

-

Enforcement of your rights: pre-litigation and litigation

Enforcement of your rights: detection of infringement, pre-litigation and litigation

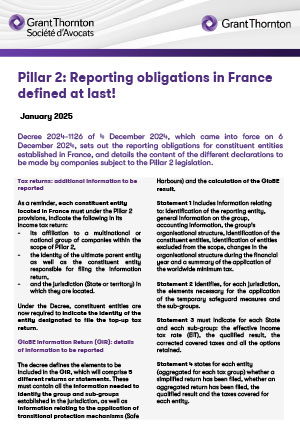

Decree 2024-1126 of 4 December 2024, which came into force on 6 December 2024, sets out the reporting obligations for constituent entities established in France, and details the content of the different declarations to be made by companies subject to the Pillar 2 legislation.

Tax returns: additional information to be reported

As a reminder, each constituent entity located in France must under the Pillar 2 provisions, indicate the following in its income tax return:

- its affiliation to a multinational or national group of companies within the scope of Pillar 2,

- the identity of the ultimate parent entity as well as the constituent entity responsible for filing the information return,

- and the jurisdiction (State or territory) in which they are located.

Under the Decree, constituent entities are now required to indicate the identity of the entity designated to file the top-up tax return.

GloBE Information Return (GIR): details of information to be reported

The decree defines the elements to be included in the GIR, which will comprise 5 different returns or statements. These must contain all the information needed to identify the group and sub-groups established in the jurisdiction, as well as information relating to the application of transitional protection mechanisms (Safe Harbours) and the calculation of the GloBE result.

Statement 1 includes information relating to: identification of the reporting entity, general information on the group, accounting information, the group's organisational structure, identification of the constituent entities, identification of entities excluded from the scope, changes in the organisational structure during the financial year and a summary of the application of the worldwide minimum tax.

Statement 2 identifies, for each jurisdiction, the elements necessary for the application of the temporary safeguard measures and the sub-groups.

Statement 3 must indicate for each State and each sub-group: the effective income tax rate (EIT), the qualified result, the corrected covered taxes and all the options retained.

Statement 4 states for each entity (aggregated for each tax group) whether a simplified return has been filed, whether an aggregated return has been filed, the qualified result and the taxes covered for each entity.

Finally, Statement 5 sets out for each jurisdiction the information needed to calculate and allocate the top-up tax.

Transitional arrangements for simplified returns

The decree also provides for the possibility of opting for a transitional arrangement for simplified returns, for financial years starting no later than 31 December 2028 and ending no later than 30 June 2030 and which have not given rise to any additional tax that requires an allocation between constituent entities in the jurisdiction.

This simplified return will simplify the 4th statement in the scope of the GIR by aggregating certain information at a jurisdictional level.

Statement of payment of top-up tax: details provided

In addition to the general information relating to the entity itself or the reporting/paying entity, the statement will have to contain in particular, information relating to:

- the additional tax due in respect of the Income Inclusion Rile IRR (or the RBII “Rile for Insufficiently Taxed Profits”, specifying the amount due by each entity liable)

- The additional national tax due by each entity

- Where applicable, the information required to allocate the top-up tax.