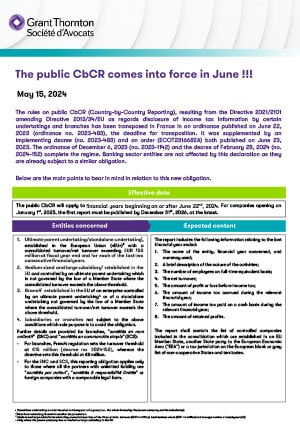

The rules on public CbCR (Country-by-Country Reporting), resulting from the Directive 2021/2101 amending Directive 2013/34/EU as regards disclosure of income tax information by certain undertakings and branches has been transposed in France in an ordinance published on June 22, 2023 (ordinance no. 2023-483), the deadline for transposition. It was supplemented by an implementing decree (no. 2023-483) and an order (ECOT2316682A) both published on June 23, 2023. The ordinance of December 6, 2023 (no. 2023-1142) and the decree of February 28, 2024 (no. 2024-152) complete the regime. Banking sector entities are not affected by this declaration as they are already subject to a similar obligation.

Below are the main points to bear in mind in relation to this new obligation.

Effective date

The public CbCR will apply to financial years beginning on or after June 22nd, 2024. For companies opening on January 1st, 2025, the first report must be published by December 31st, 2026, at the latest.

Entities concerned

- Ultimate parent undertaking/standalone undertaking1, established in the European Union («EU»)2 with a consolidated turnover/net turnover exceeding EUR 750 million at fiscal year end and for each of the last two consecutive financial years.

- Medium-sized and large subsidiary3 established in the EU and controlled by an ultimate parent undertaking which is not governed by the law of a Member State where the consolidated turnover exceeds the above threshold.

- Branch5 established in the EU of an enterprise controlled by an ultimate parent undertaking4 or of a standalone undertaking not governed by the law of a Member State where the consolidated turnover/net turnover exceeds the above threshold.

- Subsidiaries or branches not subject to the above conditions which sole purpose is to avoid the obligation.

Further details are provided for branches, ”sociétés en nom collectif” (SNC) and “sociétés en commandite simple” (SCS):

-

- For branches, French regulation sets the turnover threshold at €15 million (decree no. 2024-152), whereas the directive sets this threshold at €8 million.

- For the SNC and SCS, this reporting obligation applies only to those where all the partners with unlimited liability are “sociétés par action”, “sociétés à responsibilité limitée” or foreign companies with a comparable legal form.

Expected content

The report includes the following information relating to the last financial year ended:

- The name of the entity, financial year concerned, and currency used;

- A brief description of the nature of the activities;

- The number of employees on full-time equivalent basis;

- The net turnover;

- The amount of profit or loss before income tax;

- The amount of income tax accrued during the relevant financial year;

- The amount of income tax paid on a cash basis during the relevant financial year;

- The amount of retained profits.

The report shall contain the list of controlled companies included in the consolidation which are established in an EU Member State, another State party to the European Economic Aera (“EEA”) or a tax jurisdiction on the European black or grey list of non-cooperative States and territories.

Temporary omission

Sensitive information, whose disclosure would be seriously prejudicial to the commercial position of undertakings to which the report relates, may be omitted.

The omission is temporary. Information omitted must be published in a subsequent report within 5 years of the omission. The report must also specify the reasons for the omission.

However, it is not specified what would happen to the omitted information if the undertakings concerned no longer met the thresholds and were therefore relieved from this obligation.

It should be noted that for companies located in countries and territories that are non-cooperative for tax purposes (Appendix I and II of the conclusions of the Council of the European Union on the revised EU list), no information may be omitted.

Declaration procedures

The report, translated into French and certified as compliant, must be filed to the registry of commercial court.

As soon as it is filed, the report is then made available to the public, free of charge, for at least five consecutive years on the website of the company concerned.

When the report is published on the website of a non-French country, it must mention the name and address of the branch, or the name and registered office of the company present in France.

Where the consolidating company and one of the controlled companies have activities which may be subject to tax on profits in the same tax jurisdiction, or where the consolidating company controls several companies included in the consolidation which have activities which may be subject to tax on profits in the same tax jurisdiction, the information relating to the activities of each of the companies concerned, including their branches, is aggregated for this jurisdiction.

Responsibilities, injunctions and penalties relating to this declaration

The statutory auditors will now have to indicate whether the company is subject to this reporting obligation and, if so, certify that the report has been published and made available to the public for the financial year preceding the one for which the accounts are certified.

The board of directors, the management board, the executive directors, the legal representative of the company in France or the person with authority to bind the company in France must ensure that the company draws up, publishes and makes available the report.

In this respect, an injunction has been introduced enabling any person to request the president of the court, ruling in chambers (“reféré”), to order the company to prepare, publish or make available the report, subject to a fine if necessary.

It should be noted that there is no mention of penalties for failure to comply with this reporting obligation, even though it is up to each Member State to define them.

1 Standalone undertaking is understood as not being part of a group (i.e., the whole formed by the parent company and its subsidiaries).

2 Must have subsidiary/branch in another tax jurisdiction.

3 Medium and large subsidiaries when they exceed at least two of the three criteria, turnover (EUR 15 million), total balance sheet (EUR 7,5 million) and average number of employees (50).

4 Only where the parent company has no medium or large subsidiary in the EU.