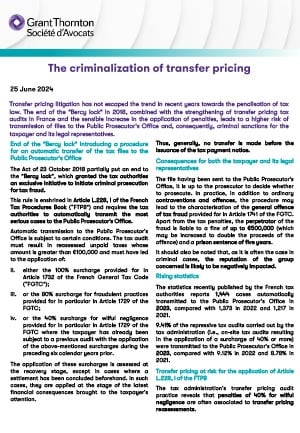

Transfer pricing litigation has not escaped the trend in recent years towards the penalisation of tax law. The end of the “Bercy lock” in 2018, combined with the strengthening of transfer pricing tax audits in France and the sensible increase in the application of penalties, leads to a higher risk of transmission of files to the Public Prosecutor's Office and, consequently, criminal sanctions for the taxpayer and its legal representatives.

End of the “Bercy lock” introducing a procedure for an automatic transfer of the tax files to the Public Prosecutor’s Office

The Act of 23 October 2018 partially put an end to the “Bercy lock”, which granted the tax authorities an exclusive initiative to initiate criminal prosecution for tax fraud.

This rule is enshrined in Article L.228, I of the French Tax Procedures Book (“FTPB") and requires the tax authorities to automatically transmit the most serious cases to the Public Prosecutor’s Office.

Automatic transmission to the Public Prosecutor's Office is subject to certain conditions. The tax audit must result in reassessed unpaid taxes whose amount is greater than €100,000 and must have led to the application of:

ii. either the 100% surcharge provided for in Article 1732 of the French General Tax Code (“FGTC”);

iii. or the 80% surcharge for fraudulent practices provided for in particular in Article 1729 of the FGTC;

iv. or the 40% surcharge for wilful negligence provided for in particular in Article 1729 of the FGTC where the taxpayer has already been subject to a previous audit with the application of the above-mentioned surcharges during the preceding six calendar years prior.

The application of these surcharges is assessed at the recovery stage, except in cases where a settlement has been concluded beforehand. In such cases, they are applied at the stage of the latest financial consequences brought to the taxpayer’s attention.

Thus, generally, no transfer is made before the issuance of the tax payment notice.

Consequences for both the taxpayer and its legal representatives

The file having been sent to the Public Prosecutor's Office, it is up to the prosecutor to decide whether to prosecute. In practice, in addition to ordinary contraventions and offences, the procedure may lead to the characterisation of the general offence of tax fraud provided for in Article 1741 of the FGTC. Apart from the tax penalties, the perpetrator of the fraud is liable to a fine of up to €500,000 (which may be increased to double the proceeds of the offence) and a prison sentence of five years.

It should also be noted that, as it is often the case in criminal cases, the reputation of the group concerned is likely to be negatively impacted.

Rising statistics

The statistics recently published by the French tax authorities reports 1,444 cases automatically transmitted to the Public Prosecutor’s Office in 2023, compared with 1,373 in 2022 and 1,217 in 2021.

9.41% of the repressive tax audits carried out by the tax administration (i.e., on-site tax audits resulting in the application of a surcharge of 40% or more) were transmitted to the Public Prosecuto’s Office in 2023, compared with 9.12% in 2022 and 8.78% in 2021.

Transfer pricing at risk for the application of Article L.228, I of the FTPB

The tax administration's transfer pricing audit practice reveals that penalties of 40% for wilful negligence are often associated to transfer pricing reassessments.

This trend in transfer pricing audit is illustrated by recent case law examples (TA Lille, 7th ch., September 15, 2023, n°2003063, SAS Wollux Diffusion, and CAA Versailles, 1st ch., May 7, 2024, n°22VE01664, SAS Medical) and can be explained by attributes inherent to the transfer pricing context.

Transfer prices occur between associated enterprises with a deemed community of interests that can thus give rise to a presumption that the parties are acting intentionally. In the same way, the membership to a multinational group may lead to the presumption that the parties are well-informed and advised. In addition, we observe that supporting economic analyses and contractual formalization are often carried out ex post. Finally, the amounts of the tax adjustments are often significant, resulting in reassessed taxes often exceeding the threshold of €100,000 required for the application of Article L.228, I of the FTPB.

Where criminal proceedings cannot be avoided, taxpayers can opt for a settlement, which can be an appropriate route in transfer pricing litigation which is not an exact science. Disputes may eventually result in the conclusion of a judicial public interest agreement (“Convention Judiciaire d’Intérêt Publi” in French) aims at avoiding a lengthy an uncertain criminal trial (For exemple: CJIP concluded on 31 May 2022 between the French Financial Public Prosecutor and McDonald's France, McDonald's System of France LLC, MCD Luxembourg Real Estate).

Our expertise

There is an increased attention from the legislator on transfer pricing issues and we observe a tightening of transfer pricing audits made possible by the recent provisions enacted in the France’s Finance Act for 2024.

In order to prevent the triggering of Article L.228, I of the FTPB, it is crucial to design and implement a robust defence strategy prior and during the tax audit. The prevention and defence against the potential application of adverse tax penalties should be performed during all the stages of the tax audit procedure before the issuance of the tax notice payment eventually through hierarchical escalations if deemed relevant.

The Transfer Pricing department of Grant Thornton Société d'Avocats has recognised expertise in tax audit assistance, transfer pricing disputes, resolution and settlements with the French tax authorities.