-

Tax Policy Management

Tax Policy Management

-

Growth Management

Growth Management

-

Tax audit and litigation

Tax audit and litigation

-

Definition of a strategic and secure transfer pricing structure

Definition of a strategic and secure transfer pricing structure

-

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

-

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

-

Annual declaration and documentation obligations

Annual declaration and documentation obligations

-

Domestic and international VAT applicable to your company's flow

Domestic and international VAT applicable to your company's flow

-

Banking and financial VAT, VAT in the insurance sector

Banking and financial VAT, VAT in the insurance sector

-

VAT related to real estate registration fees

VAT related to real estate registration fees

-

VAT in the public and non-profit / association sector

VAT in the public and non-profit / association sector

-

Tax audit, tax litigation and relations with the Tax authorities

Tax audit, tax litigation and relations with the Tax authorities

-

Applicable rules for invoicing

Applicable rules for invoicing

-

Customs issues related to your company's international flows

Customs issues related to your company's international flows

-

French VAT registration and compliance obligations

French VAT registration and compliance obligations

-

Payroll tax

Payroll tax

-

Other indirect taxation

Other indirect taxation

-

Company transfer diagnosis

Company transfer diagnosis

-

Distribution strategy : Implementing and structuring

Distribution strategy : Implementing and structuring

-

Distribution activities digitalisation

Distribution activities digitalisation

-

Relations between suppliers and distributors

Relations between suppliers and distributors

-

Contractual policy : etablishing and structuring

Contractual policy : etablishing and structuring

-

Controls and litigation regarding payment terms

Controls and litigation regarding payment terms

-

Organising and securing commercial relations with consumers

Organising and securing commercial relations with consumers

-

Data protection - GDPR

Data protection - GDPR

-

Commercial Leases

Support in the management and contract management of commercial leases.

-

Traditional Services offered

Traditional Services offered

-

Health at work and quality of life at work

Health at work and quality of life at work

-

HR Management Audit

HR Management Audit

-

HR Engineering and People Change

Implementing managerial solutions in line with the company's strategic challenges

-

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

-

Advice on legal structuring

Advice on legal structuring

-

Day to day company management

Day to day company management

-

Companies reorganisation

Companies reorganisation

-

Mergers & Acquisitions - Private Equity

Mergers & Acquisitions - Private Equity

-

Changes in shareholder structure - Securities issue

Changes in shareholder structure - Securities issue

-

Governance and legal risks management

Governance and legal risks management

-

Development of an international mobility policy

Development of an international mobility policy

-

Coordination of reporting obligations for employees in a mobility situation

Coordination of reporting obligations for employees in a mobility situation

-

Advice on social security

Advice on social security

-

Assistance in labour law

Assistance in labour law

-

Management and protection of your portfolio of property rights

We put the most appropriate protection policy in place for our clients’ intellectual property rights.

-

Securing your projects: advisory and drafting of agreement services

We advise you on the feasibility of your project and the securing of your intellectual property and IT rights.

-

Enforcement of your rights: pre-litigation and litigation

Enforcement of your rights: detection of infringement, pre-litigation and litigation

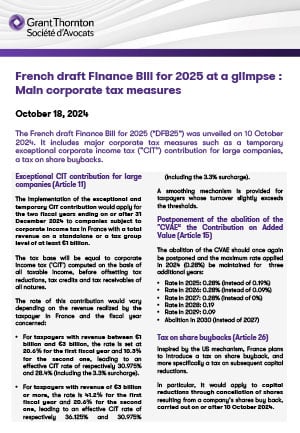

The French draft Finance Bill for 2025 (“DFB25”) was unveiled on 10 October 2024. It includes major corporate tax measures such as a temporary exceptional corporate income tax (“CIT”) contribution for large companies, a tax on share buybacks.

Exceptional CIT contribution for large companies (Article 11)

The implementation of the exceptional and temporary CIT contribution would apply for the two fiscal years ending on or after 31 December 2024 to companies subject to corporate income tax in France with a total revenue on a standalone or a tax group level of at least €1 billion.

The tax base will be equal to corporate income tax (‘CIT’) computed on the basis of all taxable income, before offsetting tax reductions, tax credits and tax receivables of all natures.

The rate of this contribution would vary depending on the revenue realized by the taxpayer in France and the fiscal year concerned:

- For taxpayers with revenue between €1 billion and €3 billion, the rate is set at 20.6% for the first fiscal year and 10.3% for the second one, leading to an effective CIT rate of respectively 30.975% and 28.4% (including the 3.3% surcharge).

- For taxpayers with revenue of €3 billion or more, the rate is 41.2% for the first fiscal year and 20.6% for the second one, leading to an effective CIT rate of respectively 36.125% and 30.975% (including the 3.3% surcharge).

A smoothing mechanism is provided for taxpayers whose turnover slightly exceeds the thresholds.

Postponement of the abolition of the "CVAE“ the Contribution on Added Value (Article 15)

The abolition of the CVAE should once again be postponed and the maximum rate applied in 2024 (0.28%) be maintained for three additional years:

- Rate in 2025: 0.28% (instead of 0.19%)

- Rate in 2026: 0.28% (instead of 0.09%)

- Rate in 2027: 0.28% (instead of 0%)

- Rate in 2028: 0.19

- Rate in 2029: 0.09

- Abolition in 2030 (instead of 2027)

Tax on share buybacks (Article 26)

Inspired by the US mechanism, France plans to introduce a tax on share buyback, and more specifically a tax on subsequent capital reductions.

In particular, it would apply to capital reductions through cancellation of shares resulting from a company’s shares buy back, carried out on or after 10 October 2024.

The companies targeted by this new tax would be those headquartered in France with standalone or consolidated revenue (excluding tax) in excess of €1 billion over the last fiscal year.

The rate of this tax is currently set at 8% and it would not be deductible for tax purposes.

‘Pillar 2’ global minimum tax (Article 13)

The DFB25 supplements the ‘Pillar 2’ system of worldwide minimum taxation of groups by transposing the administrative instructions published by the OECD to specify or clarify the application of these new rules.

These provisions concern in particular the methods for determining the deduction based on substance, the rules for applying and apportioning the domestic minimum top-up tax, and the methods for applying the transitional safe harbor provisions.

Extension of tax neutral regime following the legal reform of mergers (Article 17)

Order 2023-393 of 24 May 2023 reforming the rules governing mergers, spin-offs and partial transfers of assets was intended to make it easier to carry out such transactions within the European Union.

In particular, it introduced a new case of merger or spin-off without exchange of shares and a new definition of partial demerger.

The DFB25 makes the technical adjustments that will enable these new transactions to benefit from the CIT tax free regime. Tax law is now aligned with recent developments in commercial law.

These measures would apply retroactively to transactions registered with the commercial court as from July 1st, 2023.

Transposition of the DAC8 Directive (Article 14)

The DFB25 transposes European Directive 2023/2226 (EU) on the automatic and compulsory exchange of information in the field of taxation with regard to digital assets (Directive DAC8).

Like previous DAC directives, this text aims to establish an exchange of information on crypto assets by introducing reporting obligations for crypto asset service providers.

These service providers will be obliged to collect and report information identifying transactions relating to these digital assets, the accounts used and their holders.