-

Tax Policy Management

Tax Policy Management

-

Growth Management

Growth Management

-

Tax audit and litigation

Tax audit and litigation

-

Definition of a strategic and secure transfer pricing structure

Definition of a strategic and secure transfer pricing structure

-

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

-

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

-

Annual declaration and documentation obligations

Annual declaration and documentation obligations

-

Domestic and international VAT applicable to your company's flow

Domestic and international VAT applicable to your company's flow

-

Banking and financial VAT, VAT in the insurance sector

Banking and financial VAT, VAT in the insurance sector

-

VAT related to real estate registration fees

VAT related to real estate registration fees

-

VAT in the public and non-profit / association sector

VAT in the public and non-profit / association sector

-

Tax audit, tax litigation and relations with the Tax authorities

Tax audit, tax litigation and relations with the Tax authorities

-

Applicable rules for invoicing

Applicable rules for invoicing

-

Customs issues related to your company's international flows

Customs issues related to your company's international flows

-

French VAT registration and compliance obligations

French VAT registration and compliance obligations

-

Payroll tax

Payroll tax

-

Other indirect taxation

Other indirect taxation

-

Company transfer diagnosis

Company transfer diagnosis

-

Distribution strategy : Implementing and structuring

Distribution strategy : Implementing and structuring

-

Distribution activities digitalisation

Distribution activities digitalisation

-

Relations between suppliers and distributors

Relations between suppliers and distributors

-

Contractual policy : etablishing and structuring

Contractual policy : etablishing and structuring

-

Controls and litigation regarding payment terms

Controls and litigation regarding payment terms

-

Organising and securing commercial relations with consumers

Organising and securing commercial relations with consumers

-

Data protection - GDPR

Data protection - GDPR

-

Commercial Leases

Support in the management and contract management of commercial leases.

-

Traditional Services offered

Traditional Services offered

-

Health at work and quality of life at work

Health at work and quality of life at work

-

HR Management Audit

HR Management Audit

-

HR Engineering and People Change

Implementing managerial solutions in line with the company's strategic challenges

-

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

-

Advice on legal structuring

Advice on legal structuring

-

Day to day company management

Day to day company management

-

Companies reorganisation

Companies reorganisation

-

Mergers & Acquisitions - Private Equity

Mergers & Acquisitions - Private Equity

-

Changes in shareholder structure - Securities issue

Changes in shareholder structure - Securities issue

-

Governance and legal risks management

Governance and legal risks management

-

Development of an international mobility policy

Development of an international mobility policy

-

Coordination of reporting obligations for employees in a mobility situation

Coordination of reporting obligations for employees in a mobility situation

-

Advice on social security

Advice on social security

-

Assistance in labour law

Assistance in labour law

-

Management and protection of your portfolio of property rights

We put the most appropriate protection policy in place for our clients’ intellectual property rights.

-

Securing your projects: advisory and drafting of agreement services

We advise you on the feasibility of your project and the securing of your intellectual property and IT rights.

-

Enforcement of your rights: pre-litigation and litigation

Enforcement of your rights: detection of infringement, pre-litigation and litigation

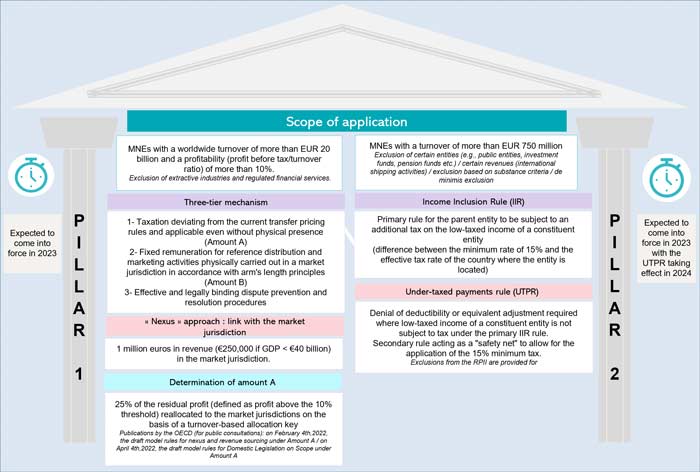

Multinational enterprises ("MNEs") are facing the biggest upheaval in international taxation in a generation. More than 130 countries, including the United States, China and India, have agreed to implement the Organisation for Economic Co-operation and Development's ("OECD") two-pillar solution on the corporate taxation of the digital economy and large global enterprises. As a summary, the first pillar sets out a framework for allocating additional taxing rights to the market jurisdictions in which goods or services are ultimately used or consumed, while the second pillar introduces a minimum effective tax rate of 15%.

Pillar 1: The new rules will only apply to around 100 global giants, although the turnover threshold may be lowered following a review in seven years' time.

The agreement would put an end to the patchwork of unilateral digital taxes that have emerged in recent years. The signatory countries have agreed not to introduce new digital taxes on their territory and to abolish existing taxes as soon as the new rules come into force worldwide.

Pillar 2: In line with the ongoing fight against aggressive tax planning, the second pillar would make it far more difficult to reduce taxes by recording profits in low-tax jurisdictions and costs in high-tax jurisdictions.

It is important to consider that the threshold for eligibility for the minimum tax floor in the second pillar is much lower than in the first pillar.

Pillar 1 and Pillar 2: coming soon?

Depending on the size of the MNE, its location and the nature of its international activities, the effective implementation of the two pillars will have a more or less significant impact on effective tax rates. While model rules have been proposed by the OECD followed by a proposal for a directive at an EU level, the final architecture of the two pillars is not yet known.

Local legislative approval has still not yet been agreed. More particularly, if the agreement is not enacted in the US, it could quickly collapse. In this respect, the Biden administration has played an important role in pushing the agreement through. A two-thirds’ majority in the Senate is normally required to enact this type of international treaty into law. Securing such support may prove difficult.

In addition, Poland has just vetoed on April 5th, 2022, the proposed directive seeking to implement Pillar 2 in the European Union.

More generally, governments around the world may be looking to see if the global agreement delivers what they believe to be their fair share of taxes. If this is not the case and the consensus collapses in return, businesses could find themselves in the worst of all worlds. The major risk should this happen, would be a return to a situation where countries act independently, bringing with it the divergence, complexity, instability and additional tax costs that entail.