On 28 December 2021, the Constitutional Council validated the Finance Bill for 2022 (“FB22”). There are few significant measures related to direct corporate tax in this new law.

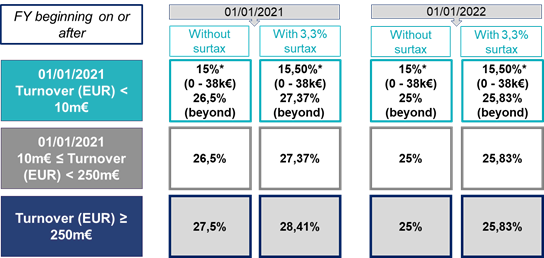

Corporate Tax rate

* conditioned on the fact that the company (1) has a turnover of less than €10m, (2) that the capital has been paid up and (3) that at least 75% of it is owned by natural persons.

Maximum interest tax deductible rate

The maximum deductible interest rate is 1.17% for 12-month periods ending 31 December 2021.

Compliance with European law of withholding taxes (“WHT”) applicable to non-resident companies (Art. 24 of the FB22)

The FB22 introduces (i) a flat-rate deduction of 10% applicable at the time of deduction of the withholding tax under Article 182 B of the French Tax Code (“FTC”) and (ii) the possibility to request a posteriori the refund of the difference between the withholding tax deducted (under Articles 119 bis and 182 B of the FTC) and the WHT calculated on the basis of a net base of the actual expenses incurred.

These measures concern legal entities or organizations (i) whose results are not subject to income tax in the hands of a partner, (ii) resident in the EU or the EEA (excluding Liechtenstein) and (iii) whose taxation rules in their State of residence do not allow the deduction of the RAS levied in France.

In addition, the possibility of requesting the a posteriori refund of the withholding tax levied under Article 119 bis of the FTC is to be extended under certain conditions to residents of a country outside the EU or the EEA.

These measures apply to withholding taxes where the triggering event occurs on or after 1 January 2022.

Finally, for foreign loss-making entities, the FB22 modifies Article 235 quater of the FTC to enable (i) claims for a withholding tax refund to be filed within the claim period (a period which expires on 31 December of the second year following the year of payment of the tax) and (ii) declarations benefitting from the tax deferral of the fiscal year in which the deferral is requested (instead of 3 months previously).

To read the full text of this alert, please download this PDF.

Our team of lawyers, experts in corporate taxation at Grant Thornton Société d’Avocats, remains at your disposal to assist you in the implementation of your obligations.